On tariffs, Trump resurrects 18th century economics

Using tariffs as a source of government revenue is pre-modern thinking

One of the policy debates within the Trump transition that I’m following most closely is about trade. During his campaign, Trump promised to put sweeping tariffs on imports from all nations, with their size ranging from 10 to 100% depending on how he was feeling that day. But it’s also never really been clear what the point of these tariffs would be. Trump has called himself the “tariff man” and seems to embrace them as a cure for all economic ills.

But the reality is that tariffs raise prices, distort markets, and stunt growth over the long term. That’s why they’ve traditionally been used by the United States as a short-term measure to coerce countries into adopting policies that are not in their interest, or to serve the narrow purpose of protecting a strategically important industry, like steel.

Blanket tariffs on all nations of 10 - 100% raise completely different issues. It wouldn’t be feasible to negotiate a trade deal with every country in the world at once, and such tariffs could serve no conceivable strategic interest. They would do a lot of harm to the U.S. economy without seeming to have any purpose. This is why a lot of observers - myself included - are very skeptical that Trump would actually follow through with them. (And I have an article about this coming out soon in a paywalled publication; I’ll provide a guest sign-in link to paid newsletter subscribers).

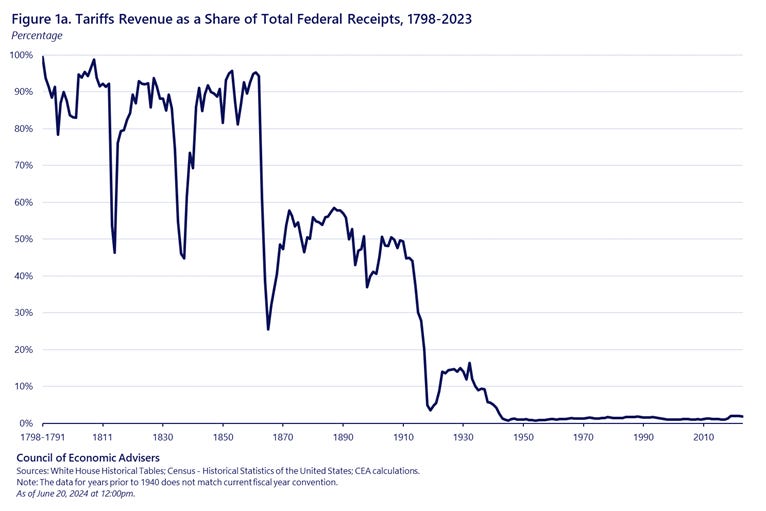

But now, an intriguing new justification for tariffs is leaking out of the transition. According to reports on CNN and elsewhere, tariffs are being discussed not as a way to advance any specific tactical economic goal but as a long-term source of government revenue. This would return tariffs to their historical roots, because for a long time after the American Revolution, they did indeed make up the main revenue source of the federal government. But it would also mean ignoring all of the very good reasons why that stopped being the case over a century ago, and why returning to using tariffs this way would be an incredibly bad idea.

In the early years of the republic, the federal government levied very few taxes. This was partly for ideological reasons - taxes were seen as an attack on economic freedom - but also partly for administrative reasons. It was very difficult to collect sales or income taxes in such a vast country and with such a small federal bureaucracy. Along with land sales, tariffs emerged as the government’s main source of revenue. They were administratively easy to levy - you just needed customs houses in the ports - and they were easier to justify ideologically because they also protected American industry and allowed it to grow. (Some early political figures, such as Thomas Jefferson, also approved of tariffs because they regarded imports as foreign luxuries which would corrupt the simple purity of the republican populace).

Keep reading with a 7-day free trial

Subscribe to America Explained to keep reading this post and get 7 days of free access to the full post archives.